Don’t let the fear of a market shift keep you up at night. With our A.I., your bot can automatically recognize trends and switch to a better strategy.

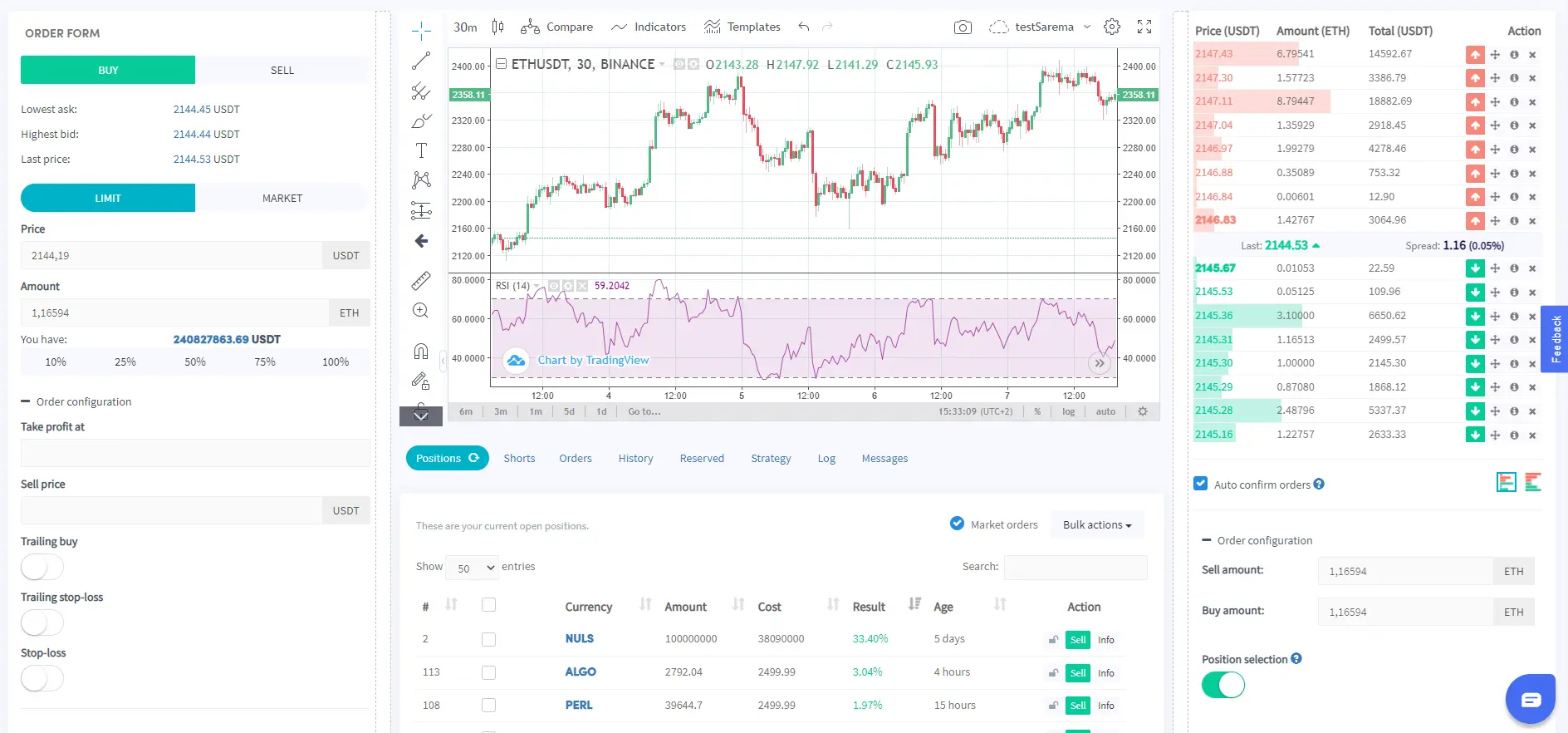

Check all charts and order books of your favorite trading pairs on the Advanced Dashboard. Save time by saving your analyses in charting templates for all your selected currencies and get a better understanding of the market conditions.

Manage your complete portfolio with Hedge Circuit, all from one place. Did you know that the basic functionality of Hedge Circuit is free? Our Pioneer package offers free manual trading. Connect all your exchanges by creating Hoppers and linking them to your exchange accounts.

Trade manually for free, thanks to our free Pioneer package. Advice: use the Advanced View to trade manually on your exchange. The positions tab helps to keep track of the positions you've bought.

Trade automatically on Hedge Circuit on your favorite exchanges. Use API Keys to connect to Binance, Coinbase Pro, OKEx, or one of the 15 supported exchanges. Your funds will always remain safe on the exchange.

Automatic trading is the holy grail of trading and probably the reason why you're here in the first place. Automated trading is a revolutionary way of trading and hasn't been available to retail traders for a while. The reason: it can be pretty complicated. Luckily, making automatic trading easy is our core business.

Apps are third-party applications that you can use in combination with Hedge Circuit. These apps increase the functionality of Hedge Circuit.

The latest and greatest innovation in E-trading. It allows traders to apply their personal trading strategies but have a bot implement it.

The beauty of working with a trading bot lies in the fact that you can backtest your strategies and configurations. That way, you don’t need to simulate your trading to see if it’s going to work out or not.

The Technical Analysis Scan Interval is the frequency at which the bot checks your strategy for potential buy or sell targets. Hedge Circuit offers three different tiers, depending on the subscription type you use. Lower scan intervals result in more buying opportunities.

These are the currencies your Hopper scans 24/7 for potential buy and sells targets. The more currencies you select, the higher your trading activity will be.

Don’t be limited by just opening one position at a time. When your Hopper spots multiple targets, they can all be bought. The Hopper can open up to 10 positions at the same time.

One subscription allows you to trade automatically on one exchange from one quote currency. The number of currencies your hopper will scan 24/7 depends on the subscription type you selected and on the number of trading pairs the exchange offers for your quote currency.

Next to every paid subscription, you can use a Paper Trading Hopper for free. It’s a Hopper that trades based on real rates with fake funds and is ideal for testing new features and strategies of the regular trading bot. The bot types Market Making and Arbitrage do need a paid subscription to simulate trading.

Don’t let the fear of a market shift keep you up at night. With our A.I., your bot can automatically recognize trends and switch to a better strategy.

Officially called “Mirror Trading,” copy trading is when you follow experts on our platform and have them decide when to buy or sell. There are several ways for you to copy traders on our platform; follow Signalers or use other traders’ strategies and Hopper templates.

Allow all currencies to receive signals for all currencies that are available with your selected quote currency on your exchange. This is a Hero Hopper feature.

Hedge Circuit's Marketplace offers everything for beginners and experienced crypto traders. For beginners, it is a great gateway to automated trading as there are plenty of Marketplace Sellers selling trading signals, templates, and strategies. An explanation is given for all of these services so you know what trading styles you can buy.

Don’t let the fear of a market shift keep you up at night. With our A.I., your bot can automatically recognize trends and switch to a better strategy.

The Strategy Designer is the place where you can create your ideal strategy. A strategy is a combination of technical indicators and candlestick patterns that can be used to open up and close positions automatically. This is the heart of your hopper. It is where the decision to enter and exit a position is made!

The beauty of working with a trading bot lies in the fact that you can backtest your strategies and configurations. That way, you don't need to simulate your trading to see if it's going to work out or not.

Hedge Circuit offers more than 130 Technical Indicators and Candle Patterns. Choose from Trend, Volatility, Momentum, and Volume indicators and combine them to design your optimal trading strategy.

One of the most exciting developments in automated trading is our unique A.I., available exclusively on Hedge Circuit. A.I. stands for Algorithmic Intelligence. No, it’s not Artificial Intelligence - well, not yet. Who knows where the future will take us?

The Hero Hopper subscription allows you to use advanced indicators, including the Average Directional Movement Index (ADX), Average True Range (ATR), Ichimoku Cloud, and Elder Ray.

Don’t let the fear of a market shift keep you up at night. With our A.I., your bot can automatically recognize trends and switch to a better strategy.

Prices between exchanges and pairs can be different due to supply and demand. Make use of these price differences without withdrawing your funds from your exchange!

The Market Arbitrage bot will look for market inefficiencies within one exchange. Your Hopper will attempt to increase the amount of the currencies you have selected as quote currencies. It will do this by taking advantage of price differences between three trading pairs available on your exchange.

The Market Maker bot provides liquidity to a market of your choice and can alternatively act as a way to profit from a big spread. The spread is the difference between the highest bid and the lowest ask. The highest bid is the highest someone is willing to offer, while the lowest ask is the lowest price someone is willing to sell his assets for. Illiquid markets have big spreads, and market makers are the ones that place orders around to spread profit from it, reduce the spread, and therefore create liquidity.

Master users of Hedge Circuit’s Loyalty Program can built their own trading features on top of the existing features by using Hedge Circuit’s API. This is a feature for power users that like to like to code their own trade ideas.

Don’t let the fear of a market shift keep you up at night. With our A.I., your bot can automatically recognize trends and switch to a better strategy.

When navigating to your dashboard, the first thing you see is the summary of your open positions, this lists a brief overview of everything the Hopper has, currently, the result and age.

Cost - The cost of your positions combined, Remember that this is the amount paid for, not the current worth of your positions

Result - The result of your current trades, Remember that this is an average and doesn't reflect the result of all the trading the hopper has done in total.

Age - The age of your positions, Remember that this is an average age and doesn't reflect the exact date per currency.

Positions - The amount of positions you currently have in your hopper.

Do you already own positions on your exchange? Easily synchronize them on your Hedge Circuit Dashboard to show them as open positions. You can sync the positions at current rates or fill in rates manually.

Do you have positions you want to HODL for a more extended period? Get a better overview of all your current assets and reserve these positions. The Hopper won’t sell these positions based on your automated sell settings.

Check out your profits, average holding time, profit per currency, an overview of all your assets over longer periods, and more.

Check out the statistics of other users that use the same quote currency on your selected exchange. Get inspired by other traders’ sell triggers and selected currencies.

One way to make up for a loss-making position is our Short and Trailing Stop-Short feature. It's an exciting feature for traders that are looking for an alternative for their traditional stop-loss.

Don’t let the fear of a market shift keep you up at night. With our A.I., your bot can automatically recognize trends and switch to a better strategy.

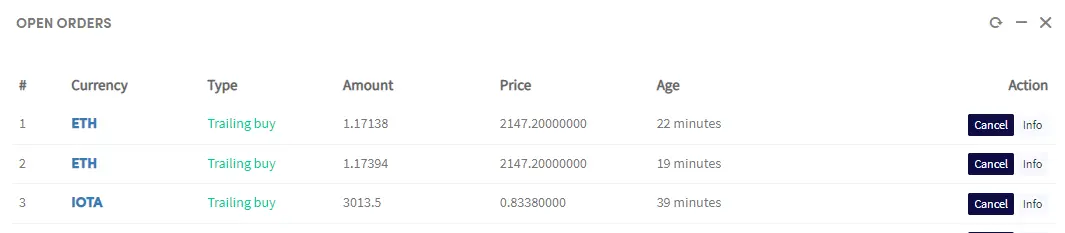

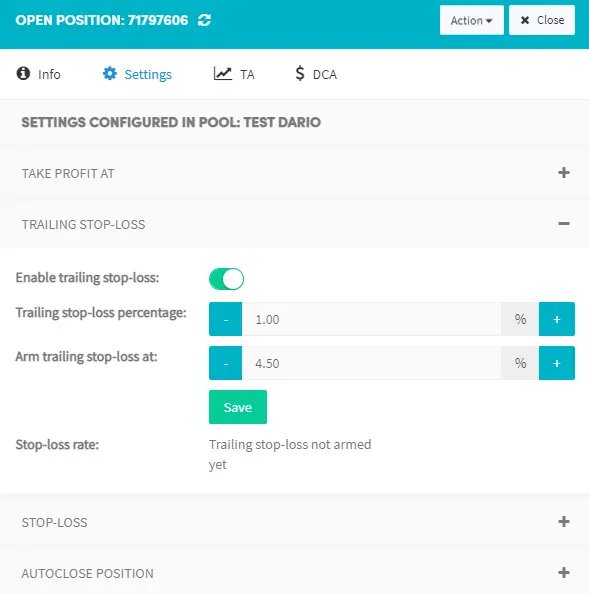

Our Trailing features show why trading with a bot is so convenient. When your Hopper is “Trailing,” it automatically follows the price and waits for an action to take when the time is right.

The Stop-loss is not a tool to make a profit but rather to minimize losses. It may feel counter-intuitive to use it, but it's vital for any trader!

One of the easiest automated selling tools. Enter the percentage profit you want to take on a position before selling it automatically. Whenever your currency goes above this percentage, your Hopper will place a sell order.

You may want to close (sell) positions automatically after a given time. This is often used by merchants and miners, who want to synchronize positions and automatically exchange them for another (stable) currency.

DCA (or Dollar Cost Averaging) is a technique that’s used either to average your buying price or to get out of loss-making positions faster by doubling down.

Officially called “Mirror Trading,” copy trading is when you follow experts on our platform and have them decide when to buy or sell. There are several ways for you to copy traders on our platform; follow Signalers or use other traders’ strategies and Hopper templates.

One way to make up for a loss-making position is our Short and Trailing Stop-Short feature. It's an exciting feature for traders that are looking for an alternative for their traditional stop-loss.